wa sales tax registration lookup

WA Sale Tax Lookup is architected as a standalone application or microservice so that youre not dependent on the State of Washingtons IT infrastructure. Some professional licenses dont list a street address and may not show up if you search just by location.

Washington The National Highway Traffic Safety Administration Nhtsa Has More Than Doubled Its Estimate For Highw Tire Safety Auto Repair Safety Infographic

Request a plate search contract.

. Tax Registration Tax registration is the second step in starting a business in DC. To calculate sales and use tax only. How to register for a sales tax registration number in Washington.

Cookies are required to use this site. Get access to the system. You can search by.

If the information on this translated website is unclear please contact us at 3609023900 for help in your language of choice. Lookup other tax rates. Washington Sales Tax Rates.

Washington WA Sales Tax Rate. Currently combined sales tax rates in Washington range from 65 percent to 104 percent depending on the location of the sale. Search by address zip plus four or use the map to find the rate for a specific location.

Build your own location code system by downloading the self-extracting files to integrate into your own accounting system. If you can provide proof that the person who gave you the vehicle or vessel paid sales or use tax on the vehicle or vessel no use tax is due. The base Washington state sales tax rate is 65 and each location county or city charges a local rate on top of that.

Vehicles received as gifts. Decimal degrees between -1250. Washington has a 65 statewide sales tax rate but also has 105 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2368 on top of the state tax.

Find a sales and use tax rate. A tax identification number ie FEIN EIN SSN is a 9-digit number issued by the IRS to classify taxpayers and collect. Taxpayers must display the registration certificate in a conspicuous location at the place of business.

360-664 3363 Fax PayeeRegistrationofmwagov. Find Sales tax rates for any location within the state of Washington. How does it work.

Ad Fill out one form choose your states let Avalara take care of sales tax registration. RCW 8232030 WAC 458-20-101. Once you have a contract to conduct plate searches follow the instructions in the Administrator Account Access User Guide to set up account access.

This is due to the way Washington defines tax boundaries and the multiple rates within the. Washington has recent rate changes Thu Jul 01 2021. You can use the following search tools to find a practitioner and lookup licensure registration Furthermore Respondent is permanently prohibited from prescribing or dispensing any schedule II controlled substance as defined.

This tool allows you to look up and verify reseller permits by individual business. Once this app has cached the sale tax data from the states website which happens on start up youre good to go until the next quarter. Gather up your applicable fees the state of Washington requires a 19 non-refundable fee for every business registered but not necessarily for sales tax and send everything to.

Information needed to register includes. Youll find rates for sales and use tax motor vehicle taxes and lodging tax. Reseller permit verification service.

Follow the instructions in the Contracted Plate Search Account Request User Guide to ask for a contract to conduct plate searches. Our mobile app makes it easy to find the tax rate for your current location. Find the TCA tax code area for a specified location.

Your browser appears to have cookies disabled. Instructions for using the Business Lookup are on the My DOR help page. A sales tax registration number can be obtained by registering through the Department of Revenues website My DOR or by mailing in the Business License Application Form BLS-700-028.

As a business owner selling taxable. If weve issued a professional license to a person or business. To calculate sales and use tax only.

This service allows you to submit a list of multiple businesses to the Department for verification. A registration certificate is required for each place of business at which the taxpayer engages in business activities. Please press Enter to open the search input box and press tab to start writing to search somthing.

Decimal degrees between 450 and 49005 Longitude. If they have professional license violations. ZIP--ZIP code is required but the 4 is.

With local taxes the total sales tax rate is between 7000 and 10500. You will need Business License registration or sales and use tax registration to run your business in Washington state. 65 Maximum rate for local municipalities.

Learn about reseller permits. Simplify the sales tax registration process with help from Avalara. Download our Tax Rate Lookup App to find Washington sales tax rates on the go wherever your business takes you.

You are now at the search section. You will get your business license after application is filed. Use this search tool to look up sales tax rates for any location in Washington.

On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 percent and 39 percent. Sales Tax Registration in Washington. Check if you have a Secure Access Washington SAW user ID.

The state sales tax rate in Washington is 6500. When their license expires. There is a state sales tax as well as various local rates.

Look up a tax rate on the go. Washington is one of the more complicated states for determining sales tax. Select the Washington city from the list of popular cities below to see its current sales tax rate.

Business license can be obtained online. If their license is active. Washington sales tax rates vary by location.

Look up a business. If the person who gave you the gift owned the vehicle for 7 years or more and is from a state or province with sales tax it will be assumed that tax was paid and no proof is.

How To Become Active Taxpayer In Fbr Income Tax Income Tax How To Become Tax

File Sales Tax Online Department Of Revenue Taxation

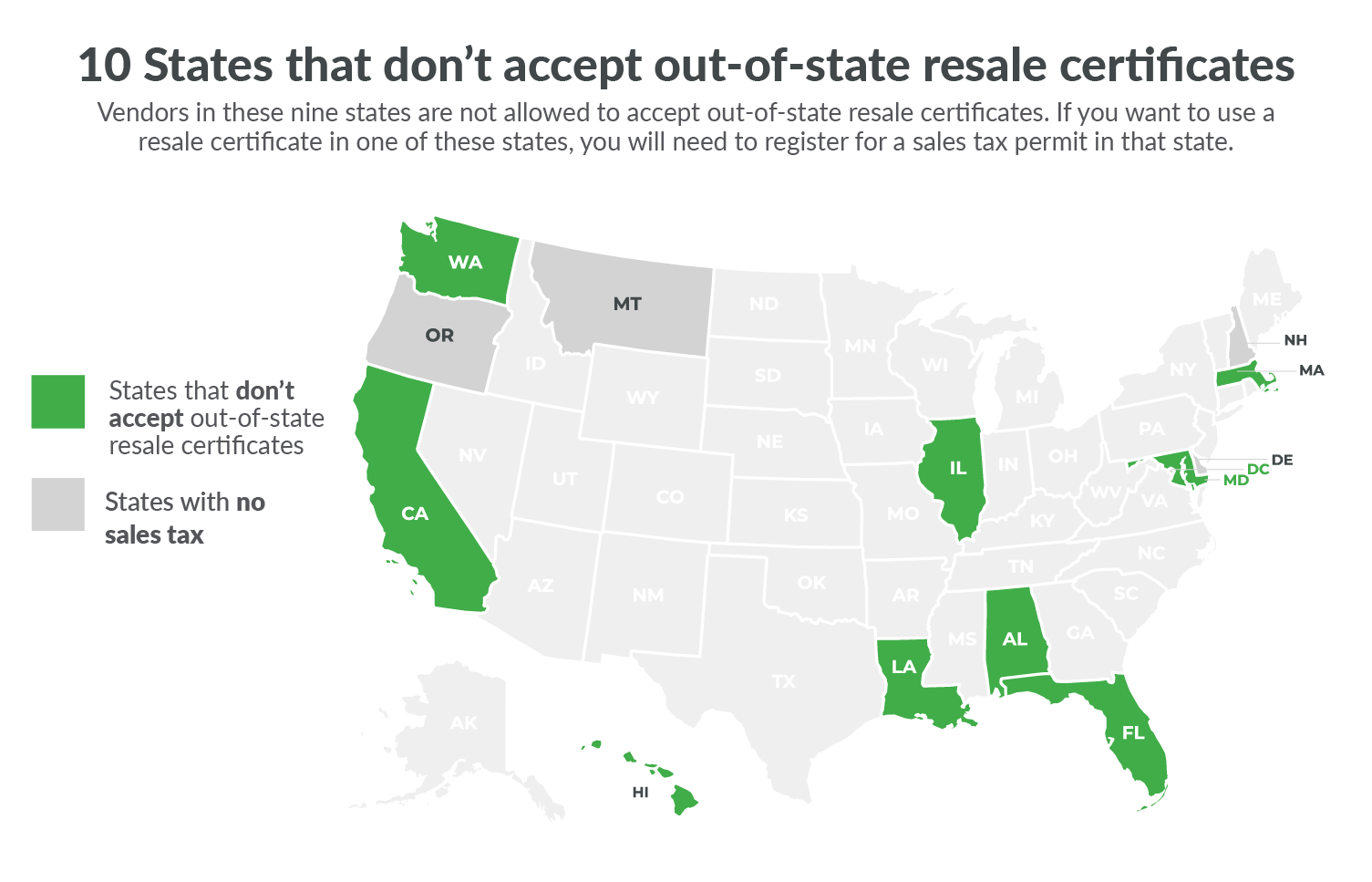

10 States That Won T Accept Your Out Of State Resale Certificate Taxjar

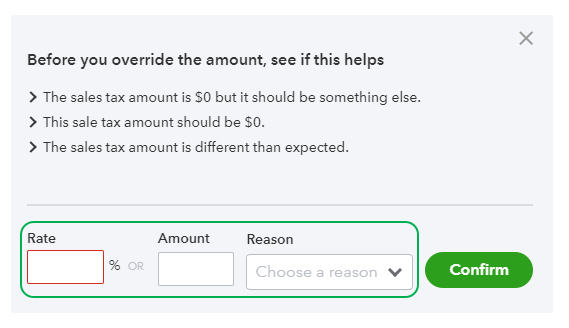

Setting Up Sales Tax In Quickbooks Online

Sales Tax By State Is Saas Taxable Taxjar

Montana Motor Vehicle Bill Of Sale Form Download The Free Printable Basic Bill Of Sale Blank Form Template Or Waiver I Bills Things To Sell Template Printable

Solved Should I Enter My Sales Tax As An Expense Every Time I Pay It Or Is That Automatically Figured Into My Profit And Loss Statement From The Sales Tax Program

Cancellation Of Homestead Deduction The District Of Columbia Here S A Free Template Create Ready To Use Forms A Deduction District Of Columbia How To Apply

Please Check Out All The Photos And Contact Me With Any Questions Free Shipping To The Usa Vintage Stamps Postage Postage Stamp Collecting Postage Stamps Usa

File Sales Tax Online Department Of Revenue Taxation

How To Collect And Pay Sales Tax In Quickbooks Desktop Youtube

Washington Sales Tax Small Business Guide Truic

Resale Certificate How To Verify Taxjar

What Is Sales Tax Nexus Learn All About Nexus

How To Collect Record Sales Tax In Quickbooks Online Tutorial Youtube

What Is My Sales Tax Id Number Craftybase